0086 18049845758

GOLDEN PAPER

GOLDEN PAPER

GOLDEN PAPER

GOLDEN PAPER

The European pulp and paper industry is currently at a pivotal point, encountering a mix of unprecedented challenges and promising opportunities.

For professionals in this sector, grasping these dynamics is essential for maintaining a competitive edge. A comprehensive understanding of the market can provide actionable insights to successfully steer companies through the future.

Current Industry Challenges in Europe

Like many other regions, the European pulp and paper industry is currently facing several challenges in a rapidly evolving market. These challenges include:

Managing Grade Turbulence: The European pulp and paper industry is currently navigating through a period of grade turbulence. While the demand for printing and writing paper is on the decline, the containerboard sector is experiencing robust growth. This shift necessitates companies to swiftly adapt to evolving market trends. Focused grade management can enable businesses to enhance production efficiency and reduce losses.

Sustainable Fiber Availability: With the growing focus on sustainability, the availability of sustainable fiber is becoming increasingly volatile. The competitive use of wood for various applications, from construction to bioenergy, is adding pressure on pulp and paper manufacturers.

Cost Optimization: Energy costs and CO2 emissions are critical factors in the pulp and paper industry’s operational efficiency. The European Union’s stringent regulations on carbon emissions are pushing companies to find innovative ways to reduce their carbon footprint. Investing in energy-efficient technologies and renewable energy sources can help companies optimize costs and comply with regulations.

Retail and Brand Owners' Focus on LCA Structure of Packaging: Retailers and brand owners are increasingly scrutinizing the Life Cycle Assessment (LCA) packaging structure. High CO2 emissions are becoming a significant concern, and companies that fail to address this will face pressure from their clients. Proactively reducing emissions and enhancing the sustainability of packaging can give businesses a competitive edge.

Overview of the Current Market

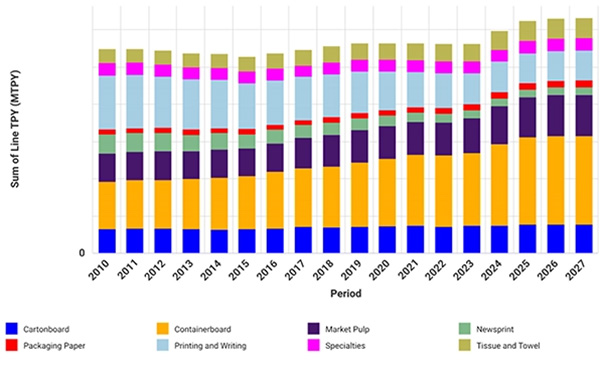

Upon analyzing the current state of the European pulp and paper market, it is evident that while overall capacity has remained steady in recent years, there have been significant shifts in the product mix.

Containerboard, cartonboard, and packaging paper have displayed a notable Compound Annual Growth Rate (CAGR) increase between 2010 and 2023. Conversely, printing and writing paper, as well as newsprint, have witnessed declines over this period.

European Pulp and Paper Capacity (Actual and Announced)

Source: FisherSolve

Looking ahead, several capacity increases have been announced for the 2024-2027 period. Turkey in particular is set to add the most significant containerboard capacity in the coming years.

However, many previously announced projects have either been delayed, canceled, or not yet started due to overcapacity and uncertain demand forecasts. Unlike Europe, the US containerboard market, with its more consolidated supply side, has not implemented similar investment plans. As Europe continues to invest, its machine base will become increasingly competitive compared to the US.