Recently, Nine Dragons Paper, a leading company in the packaging paper industry, once again announced an increase in paper prices, mainly involving paper types such as containerboard, corrugated paper, and cardboard. At the same time, the price of waste paper upstream of the industrial chain has also shown a steady upward trend recently.

Xu Ling, a corrugated and containerboard market analyst at Zhuochuang Information, told the Securities Daily reporter: "The second quarter is the traditional off-season for the packaging paper market represented by containerboard. In the third quarter, the market gradually entered the peak season, demand improved, and the supply and demand relationship may be eased. It is expected that market prices may be raised."

Zhuochuang Information monitoring data shows that since the second quarter, the national average price of containerboard has been 3659/ton, a month-on-month decrease of 4.54% and a year-on-year decrease of 7.26%. Xu Ling analyzed that the contradiction between supply and demand in the containerboard market in the second quarter was more prominent, and the gap between supply and demand widened year-on-year and month-on-month, which was the main reason for the weak price decline.

This time, packaging paper companies continue to raise the price of base paper, and at the same time, the price of waste paper has also begun to rise. Can it be regarded as a signal of industry recovery?

Xu Ling said: "From the demand side, the third quarter gradually entered the traditional peak season of the market. Orders for the Mid-Autumn Festival and National Day were released one after another. There is an expectation of incremental terminal orders, which will drive the overall consumption of packaging paper such as boxboard."

Dongxing Securities recently released a research report that after entering the traditional peak season, paper prices are expected to benefit from the release of demand. With the current increase in US waste prices, the cost advantage of imported paper will narrow, and the impact on the supply side will weaken, which is conducive to paper companies stabilizing prices in the off-season and implementing price increases in the peak season.

Faced with market fluctuations in the packaging paper industry, the efforts of leading paper companies to layout the high-end market are also increasing. At present, the proportion of high-end products of boxboard in the Shandong base is high, and the overall profitability is stable. The company is working hard to increase the proportion of high-end products of boxboard in the Nanning Park of the Guangxi base, and profitability is gradually improving.

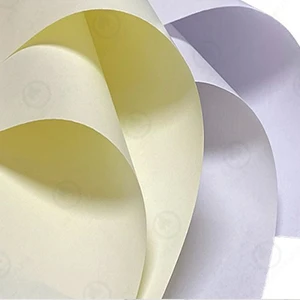

Unlike the packaging paper industry, which is shifting from the off-season to the peak season, the market demand for the cultural paper industry has begun to weaken recently as the bidding season has basically ended. Although pulp prices are higher than in previous years, the logic that paper prices rise with pulp prices is difficult to reproduce due to the drag of demand, and the overall profitability of the industry is under pressure. This is reflected in the prices of finished paper. Since the second quarter, the prices of cultural paper and white cardboard have both rebounded.

Kong Xiangfen, an analyst at Zhuochuang Information, told the reporter of Securities Daily: "Under the current background of industry profit pressure, the enthusiasm of white cardboard companies to schedule production has declined. Although paper companies have begun to test price increases, downstream companies are mostly cautious about price increases. There is still resistance to the market going up, and actual transactions have yet to be implemented."

GOLDEN PAPER

GOLDEN PAPER

EN

EN

fr

fr  de

de  es

es  it

it  ru

ru  pt

pt  ar

ar  vi

vi  tr

tr  id

id