Since the radical interest rate hike cycle in March 2022, the Federal Reserve announced its first interest rate cut, lowering the federal funds rate by 5 basis points to 4.75%-5%, marking a new chapter in the shift of monetary policy from a tightening cycle to an easing cycle. In addition, the dot plot released on the same day indicates the future path of monetary policy. It is expected that interest rates will further drop to 4.4% in 2024, suggesting that there may be additional room for interest rate cuts during the year.

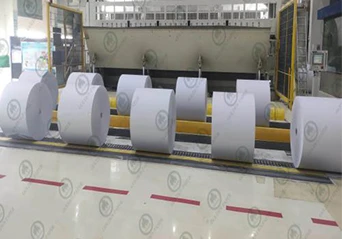

So, what is the impact behind this policy? For the paper industry, interest rate cuts will undoubtedly bring new opportunities and challenges.

First of all, this interest rate cut is a silent encouragement for companies that have persisted in the sluggish economic environment in the past two years. In addition, lower U.S. dollar interest rates will also cause investors to seek investment opportunities with higher returns, and assets in emerging markets often become their targets. As far as the paper industry is concerned, the Federal Reserve's interest rate cuts may reduce financing costs for companies, making it easier for large paper companies to obtain financial support, thereby accelerating the pace of their transformation and upgrading.

Secondly, the most significant impact is the appreciation of the RMB and the enhancement of purchasing power. Specifically, a U.S. dollar interest rate cut will usually cause the U.S. dollar index to fall, and an appreciation of the RMB will help boost the performance of RMB assets. This is definitely more good than bad for some countries that rely on imports. my country's pulp import dependence exceeds 60%, and the appreciation of the RMB means that the company's costs can be reduced for the same amount of pulp, which is of great benefit to the paper industry, which has low profit margins.

GOLDEN PAPER

GOLDEN PAPER

EN

EN

fr

fr  de

de  es

es  it

it  ru

ru  pt

pt  ar

ar  vi

vi  tr

tr  id

id